Welcome to our monthly survey of developments in the world of ebikes where we describe some of what’s been happening, but, more importantly think through how and why those events are significant in the bigger scheme of things.

This month two themes are prominent:

- A wave of bankruptcies

- E-bikes overall going strongly

Yes. Two forces going in opposite directions—it is crunch time for many, yet just the beginning for others.

Contents

Looking Ahead to 2030

The 2020s will forever be looked upon as just as important a period as the 1890s, the time of the first bicycle boom.

The rapid adoption of e-bikes has brought us into the era of micromobility and certainly the end of the rule of the car in many inner city areas in developed nations.

(Here’s what one lady saved by replacing the 11,000km she would have traveled in a car on an e-bike)

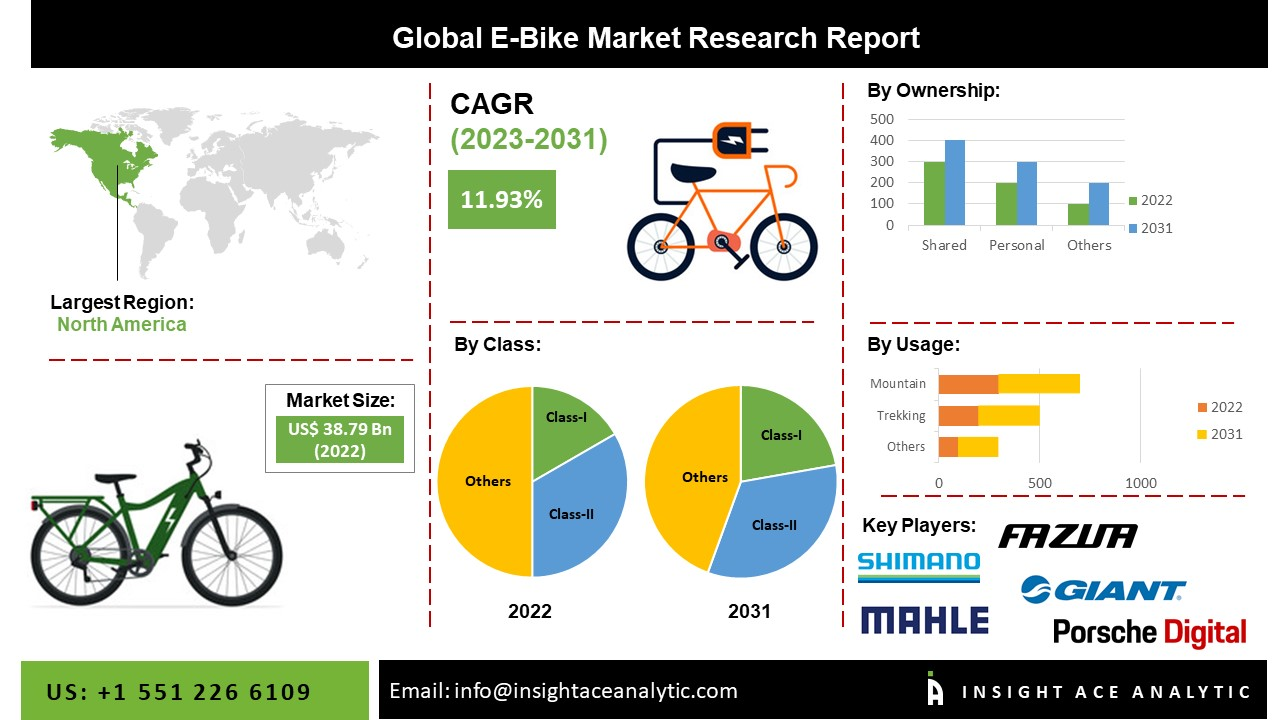

InsightAce Analytic’s E-bikes Market Size, Share and Trends Analysis to 2030 provides a look at what to expect in the second half of this revolutionary decade. You’ll get some interesting summarized points, but the full report is behind a pay wall.

Perhaps this survey says all that needs to be said about the future of e-bikes. It finds that 49% of big city residents would be “extremely likely” to switch to an e-bike as long as there was a good enough financial incentive on offer.

The incentive is the proposed E-BIKE Act which among a host of other points grants financial support for up to 30% to buy a new e-bike capped at a maximum of $1500. And that’s the catch. Most of those indicating they would buy an e-bike say they would do so only if the tax credit was doubled to $3000. That won’t happen but if the credit did indeed double, and the population truly followed through, the significance of what it would mean for the bike industry is staggering.

Europe is well on the way to widespread e-bike adoption which is largely driving the market now. With a little more support, though, the might of the US consumer would propel the market to new heights.

Problems of Digital Integration

The digital revolution moves in two opposite directions at once. There is:

1. The convenience of having almost totally uninterrupted access to a wealth of computer-mediated functions via the internet and now the mobile internet—a decentralized utopia with nobody in charge.

2. The creation of convenient applications that however restrict the user to a restricted and controlled environment—follow the rules, or lose access to the functions and conveniences of operating in and through that environment.

Access to more and more powerful computing resources via mobile internet is made possible through the TCP/IP protocol and HTML in which every device can “talk” to every other device

A walled garden, on the other hand, refers to a controlled online environment where access to content and services is restricted and controlled by a single entity, usually a platform or service provider. This concept involves creating a closed ecosystem where users are encouraged to stay within the confines of the platform’s offerings. Examples include app stores (like Apple’s App Store), social media platforms (like Facebook), and proprietary messaging services (like WhatsApp).

The demise of the big e-bike brand, VanMoof has brought the problem of walled gardens clearly into view, particularly for e-bike consumers

The highlighted danger was that the company’s servers would be taken offline and with them the means for customers to access their VanMoof e-bike—what do you do when the digital key to your e-bike is inaccessible, stuck inside the VanMoof walled garden?

The answer is to have the ability to copy the key and save it onto another server. Hence a rival e-bike brand, Cowboy, quickly built an app that VanMoof e-bike owners were able to use to guarantee access to their bikes.

This discussion of the problems and solutions to the software, authorization and proprietary aspects of e-bike software suggests that proprietary software should be automatically be transformed into open source in the event of bankruptcy. Then owners of e-bikes affected by the fate of that code could collectively arrange for the hosting and maintenance of the code.

In other words, the walled garden problem would automatically vanish. The software to make this happen would have to be in place prior to the event, though, and we would only have a company’s word that the mechanism was indeed in place—every brand has an incentive to ensure the walls remain in place, since the technology in question is proprietary and is the main part of their competitive advantage.

Maintenance and Repair Dilemma

Related to the problem of proprietary software is the problem of who should be authorized to repair, maintain, or otherwise tinker with an e-bike.

In the 120 or so years since Starley’s safety bike led to the mass adoption of the bicycle around the world, repair and maintenance has been carried by owners. A few basic tools and a little knowledge allowed anyone to keep a bike on the road

Well, sometimes more than a little knowledge since bikes have become increasingly complex over the years, especially in the last 10-15 years. Companies have thus made available the manuals and technical information required for anyone working on proprietary components. Disclaimers often accompany these documents warning that warranty can be voided or simply that serious injury could result from any “disassembly” or work done by non-qualified technicians.

When it comes to e-bikes, many brands don’t make the parts, tools, and information needed to maintain or repair their products readily available to anyone. Right-to-repair legislation aims at preventing brands from withholding these items so anyone can indeed work on products they own.

E-bike companies are arguing the case for their exclusion from such legislation, however, citing the need for disabled or broken batteries in particular to be simply recycled, and not given a new lease of life.

One foundation for the argument is the spate of battery fires. However such fire events would appear to be overwhelmingly caused by low-quality white label or no-name branded batteries which lack a BMS that, among other things, cuts off the power to a battery when it’s fully charged.

An answer is perhaps for legislation to finely delineate different use cases and scenarios: who is authorized to do what under which circumstances. Administration and enforcement would probably render such an approach unworkable and clamping down on battery production by no-name brands may be a more useful way to go.

The Power of a Brand

“A brand is the most valuable piece of real estate in the world: a corner of someone’s mind,” commented advertising expert and winemaker John Hegarty.

One advantage of powerful brand is that in a world of abundance where there are way too many choices in every product category, it simplifies the decision-making process.

As consumers we often default to the brand we know rather than go through the time-consuming and mentally taxing process of sorting through the possibilities, getting to the short list and then arriving at the final decision.

Here’s a perfect example of the power of brand in the results of a recently conducted survey:Tesla is the most desired brand to build an e-bike … for men anyway, and at the highest price point—they’re prepared to pay most for a Tesla. However, in absolute terms, the top brand overall is Amazon followed by Apple (millennials would most like to see a “marvel” themed e-bike).

Why Amazon over Apple? The assumed lower price point would be more appealing than Apple premium kit for many. And objectively, Amazon’s record with own-brand electronics is modest . . . the Kindle is good, not great. Other Amazon-branded products seem to have earned a meh level of acceptance from the market or failed outright. All things being equal we could probably expect a Tesla e-bike at sooner than later. But the mercurial boss of the world’s biggest car brand by a huge margin makes that a hard bet to take.

History Repeats—bicycle > motorbike 1.0 > bicycle > 2.0?

The modern bicycle —a triangle frame mounted on two equally sized wheels with a rear wheel chain drive—appeared on roads in the mid 1880s.

And at almost exactly the same time, Gottlieb Daimler put an engine in the front triangle of one to create the first motorized bike, the Daimler Reitwagen, with the first e-bikes appearing in the 1890s.

The same thing is happening again . . . well, sort of. The context right now is ‘micromobility’ and the conceptual role of LEVs (Light Electric Vehicles) makes current developments unique.

Nevertheless, this full-suspension electric moped with 2-speed motor places design right at the intersection of e-bikes and motorbikes remembering that e-motorbikes are also a rapidly developing category in their own right.

Is history, then, actually repeating in the age of micromobility? Perhaps . . . but it’s an academic point. The real story remains one about the rise of a wide range of e-bike models catering to a much more broad consumer base than was the case 120 years or so ago.

Cargo Bikes

The electric cargo bike category continues to develop rapidly. Yet purchasing an e-cargo model is prohibitively expensive for the mass of consumers with modest means who still could use one to possibly replace their car. Or be the car they could not afford to have.

MyCycle cargo has identified this underserved niche in the form of their “Cargo”.

Again, as with all of the products we discuss in these articles, it’s not about the bike in itself, but what it represents as a category, as a sign-of-the-times, if you like.

From one point of view, the Cargo has the elements of the modern e-bike generally speaking: step through frame, fat tires without being a fat bike per se, storage on the front and rear (many bikes of this type include at least one front or rear). A comfortable, practical, although not particularly attractive.

What distinguishes it is the price point—the Cargo comes in at about half the price of a comparable Tern GSD or Rad Power’s RadWagon 4 for reference. Sure there are ostensibly similar offerings at even a lower price point. But the issue is quality—you get Tektro brakes and Shimano Altus which, yes, are lower on the component food chain but generally durable and reliable.

On the subject of (e)cargo bikes AND the subject of converting “m” bikes to “e”. Conversion solutions have been around for a while although not focused on cargo bikes.

The linked article is required reading for DIY mechanics, not because it’s the ultimate how-to guide, but because it brings into relief the general issues to consider and things to look out for in the process of conversion.

One last item is Magura’snew Combined Braking System for e-bikes. It works through a “brake force distributor” which connects the brake lever on the handlebars to the disc brakes on the wheels. It also automatically directs part of the braking force to both the front and back brakes, which Magura claims improves braking distance by up to 40%.

Cargo bikes are hefty particularly with a full load under electric assist or perhaps full power from a hub drive. We’ll likely see more efficient braking systems from the many brands over the next few years.

This is also an area with huge potential for AI input you would think. It won’t be long before we see product offerings utilizing what will arguably the dominant technological innovation of the 2020s and beyond.

Belt Drives vs Chains

Belt drives have appeared as e-bikes have picked up in popularity over the years, with each unfolding on its own development trajectory though.

A clear trend now is to use belts in e-bike drives rather than chains which must be replaced MUCH sooner on e-bikes than on bikes without engines—the torque is a chain killer.

Only Taya among the chain makers has come up with an explicit answer to the problem of fast-wearing chains. Nevertheless a belt lasts3-5 times longer than a chainreplacement of which is usually recommended every 1000 km.

As belt drives gain fans over time, the belt will probably emerge as a key feature particularly as geared hubs and mid-drives proliferate since internal transmissions allow a cyclist to escape the restriction to a single speed. Priority Bicycles appear to be thinking along these lines with the launch of a cheap(ish) belt drive e-bike. Are we looking at the start of a trend? Possibly . . . certainly towards much cheaper e-bikes with only slightly reduced capabilities compared with much more expensive options.